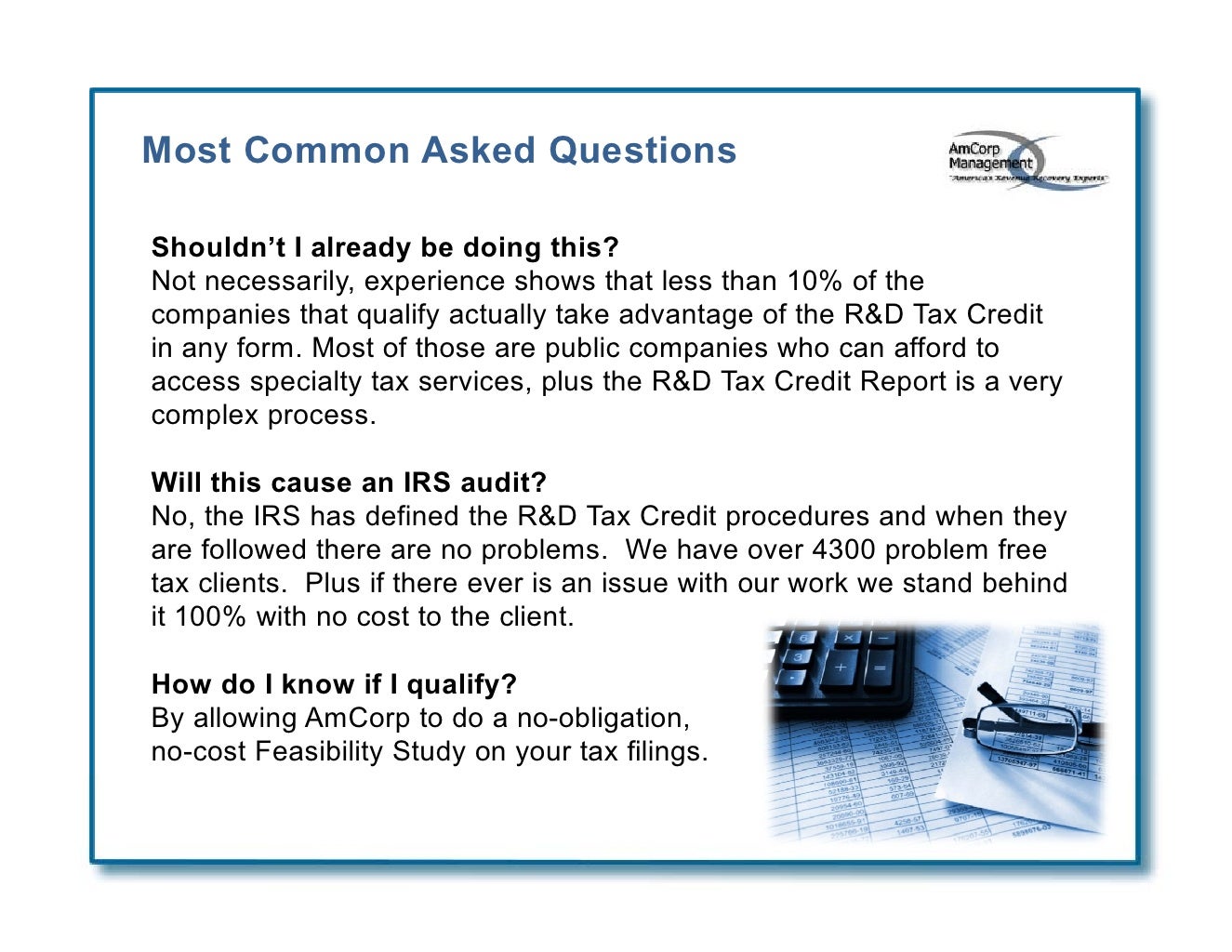

Buyer beware. For sole proprietorships, partnerships, and S-corporations the R&D credit is claimed by filing Form 6765 with the business return (Schedule C of a Form 1040, Form 1065, or Form 1120.. The R&D tax credit is both a federal and state incentive, with roughly 70% of states offering it. The first step to taking advantage of this tax strategy is to determine the areas of opportunity within current business operations. — Karen J. Koch, CPA, MT, is a partner of Bedford Cost Segregation, located in Louisville, Ky.

How do you claim R&D tax credits?

![There’s Still Time to Claim the R&D Tax Credit on Extension [Infographic] There’s Still Time to Claim the R&D Tax Credit on Extension [Infographic]](https://www.kbkg.com/wp-content/uploads/RD-Infographic.png)

There’s Still Time to Claim the R&D Tax Credit on Extension [Infographic]

R&D Tax Credits Explained What are they? Your FAQ's Answered

R&D Tax Credits

What are R&D Tax Credits? YouTube

R&D Tax Credits

Reasons To Do Business in Ireland Research and Development (R&D) Tax Credits Roberts Nathan

R&D Tax Credits The Essential Guide (2020)

How can my construction company claim the R&D tax credit?

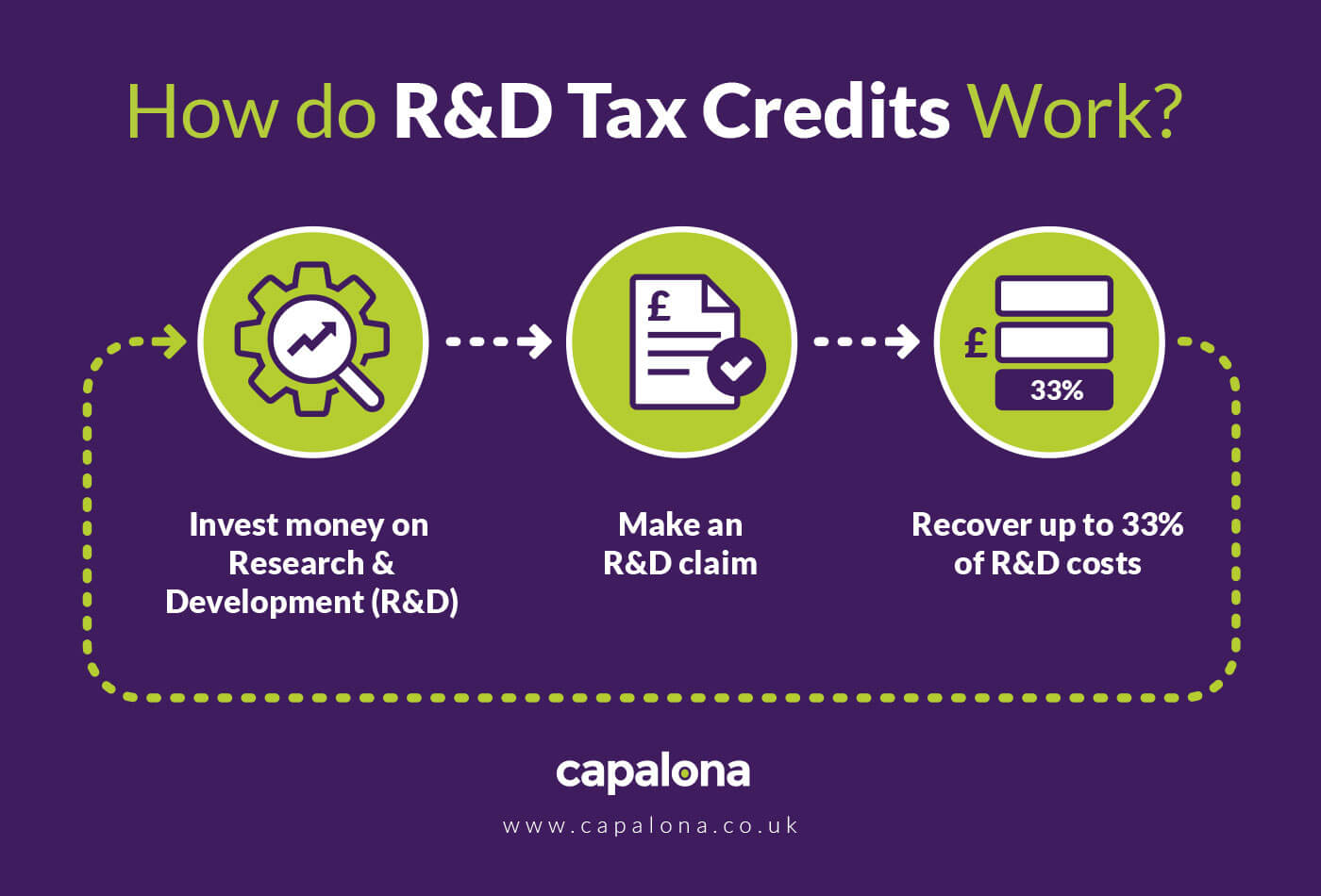

R&D Tax Credits UK What Is It & How To Claim Capalona

R&D Tax CreditsR & D Tax CreditsClaim what you deserve

Funding Innovation with R&D Tax Credits Fleming

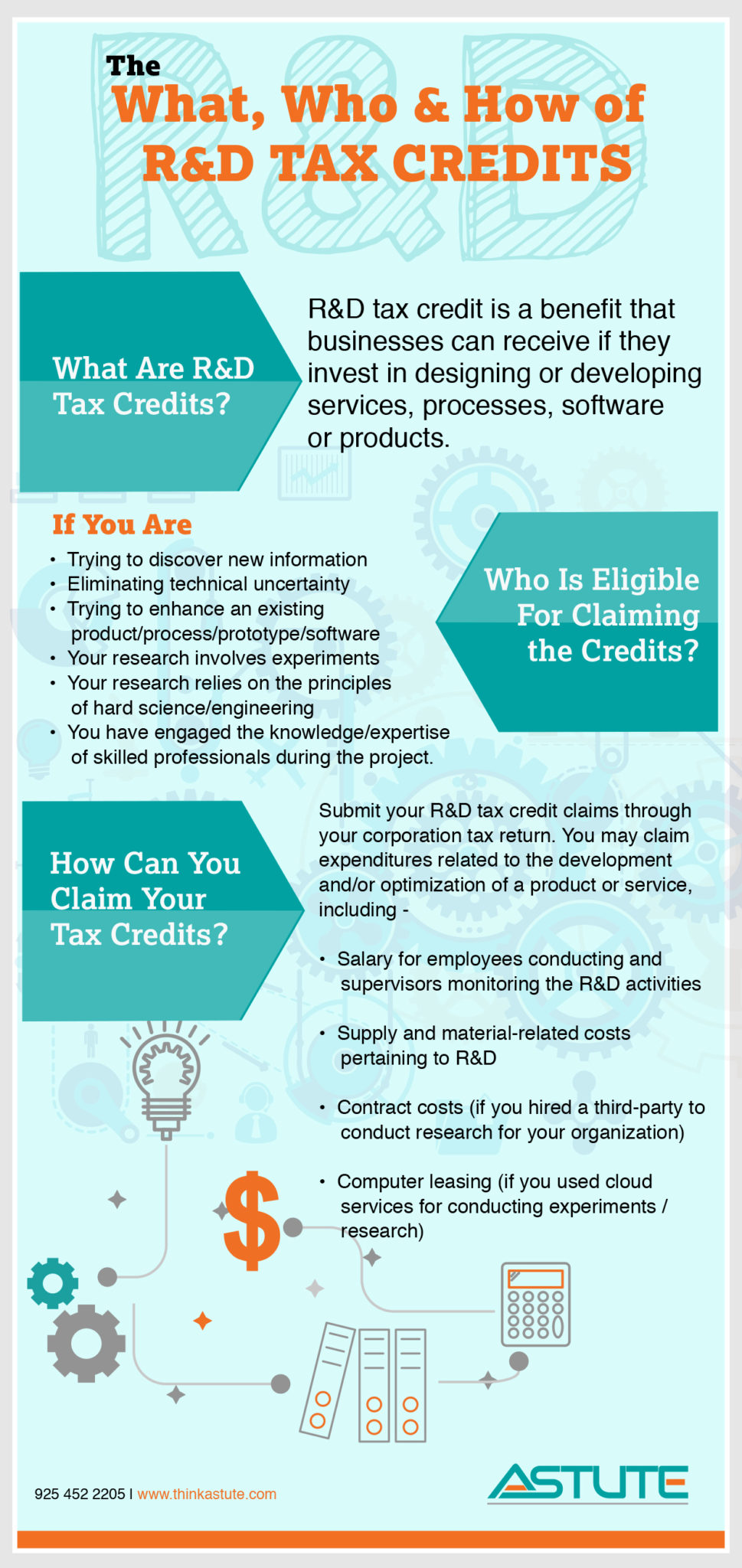

Are You Eligible For R&D Tax Credit? Find out using this infographic Astute Tax & Accounting

R&D Tax Credit (All Questions Answered) Bookkeeper360

R&D tax credit Does your business qualify? Our Insights Plante Moran

How To Be Proactive With R&D Tax Credits Accountants Guide

R&D Tax Credits Research and Development Topel Forman LLC CPAs

An Infographic on HMRC R&D Tax Credits RDP Associates

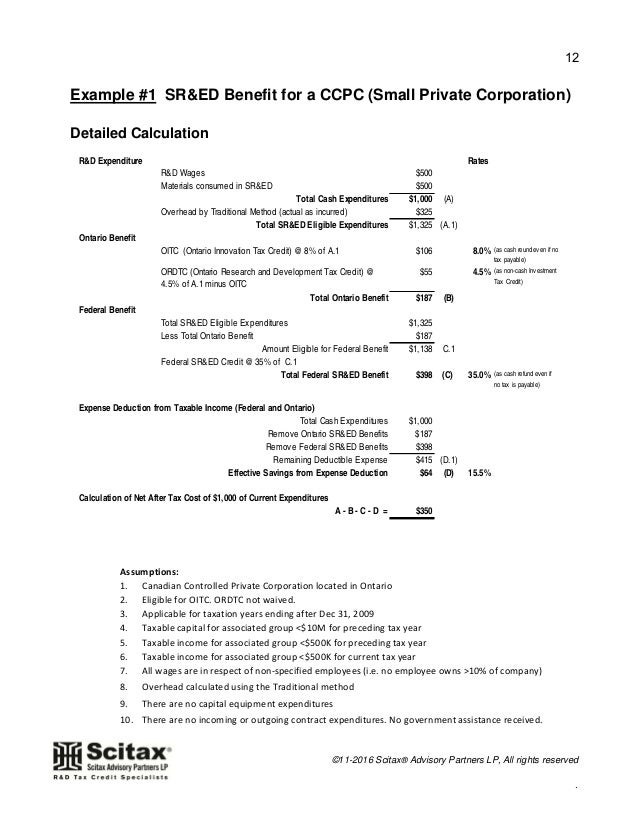

Introduction to R&D Tax Credits in Canada with Worked Examples for Sm…

R&D tax credits explained what are they? made.simplr

R&D tax credit rules summary. Federal and certain states tax laws permit a research and development (R&D) tax credit to the extent that a taxpayer s current-year qualified research expenses exceed a calculated base amount of research spending. The federal and state credit benefits are generally greater than 10 percent of qualified spending for.. The research and development (R&D) tax credit is one of the most significant domestic tax credits remaining under current tax law. Savvy corporate tax teams can use this important tool to implement federal tax planning strategies that maximize their company's value.. However, the tax issues around R&D investment and acquisitions are not trivial.