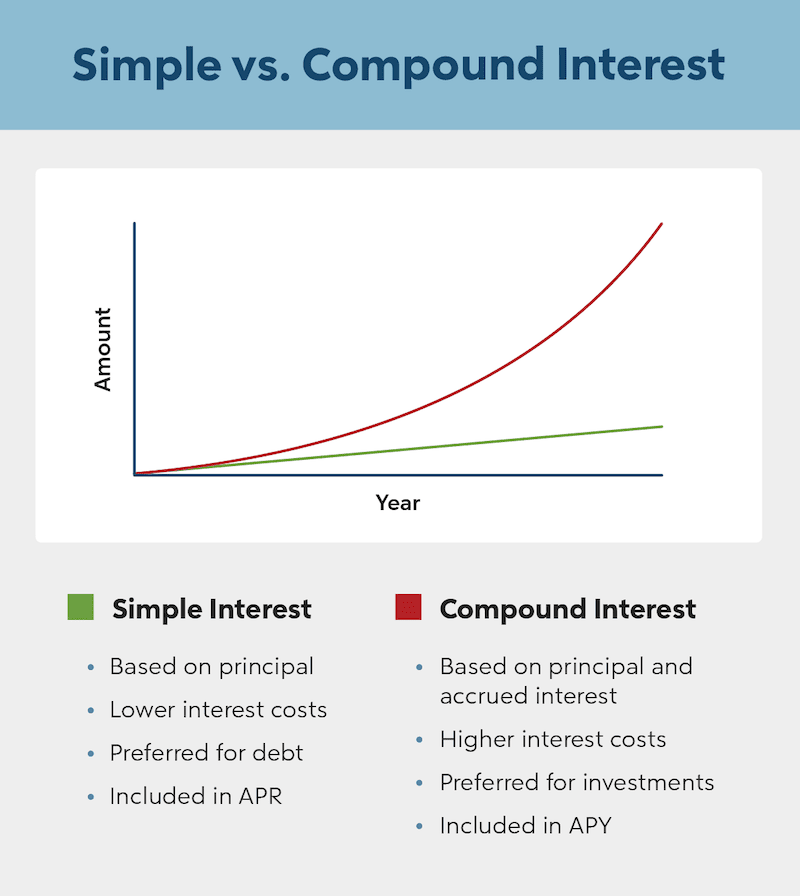

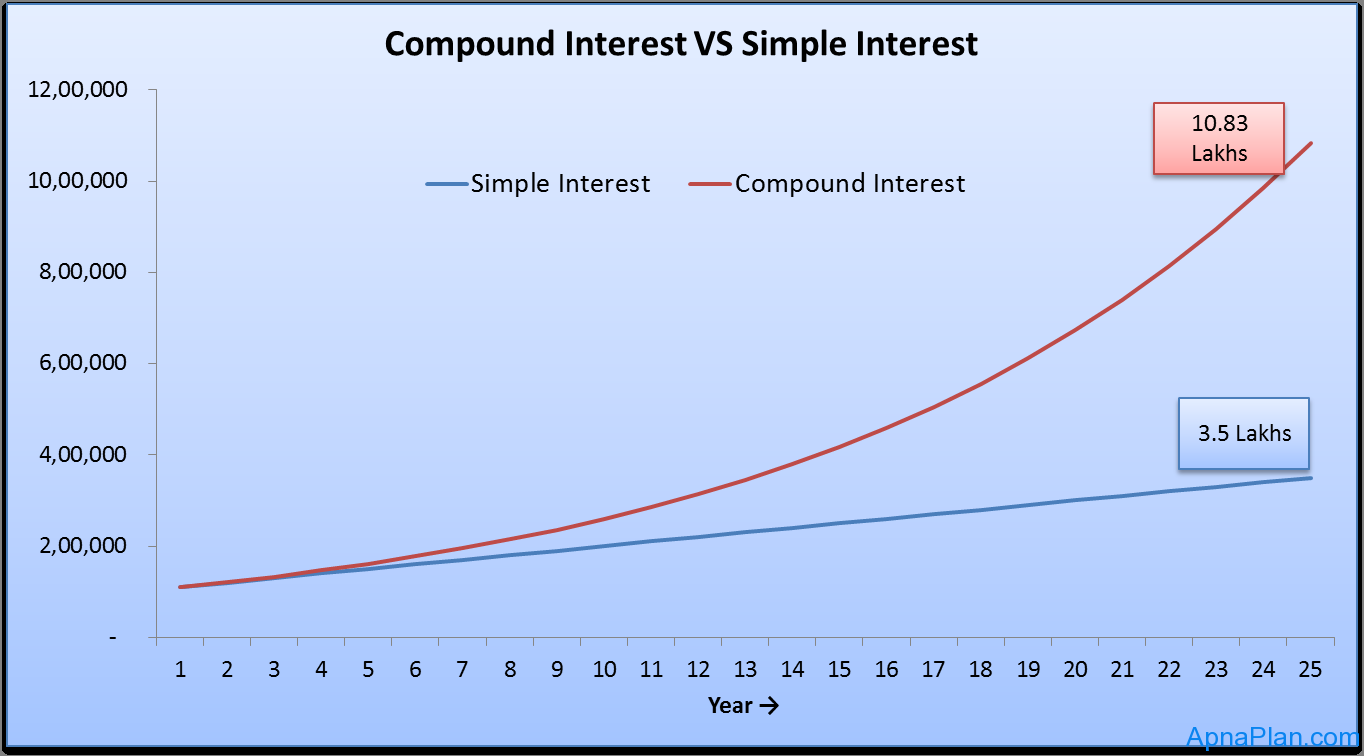

Simple interest is the percentage of a loan amount that will be paid by the borrower annually in addition to paying the loan principal. Compound interest may be the same percentage rate, but it is.. Simple interest and compound interest are key financial concepts when it comes to borrowing, saving and investing money. Simply put, simple interest and compound interest are two different ways of calculating the interest owed on a loan or the interest earned on savings or investments. As it relates to loans, simple interest refers to the amount of interest paid on the principal, or original.

What Is The Difference Between Simple And Compound In vrogue.co

Simple and Compound Interest

Simple interest vs Compound interest Differences and Definitions MakeMoney.ng

Simple vs. Compound Interest How to Tell the Difference

Different Types Of Interest

Compound Interest How to use the Effect Correctly GELVOS

Compound interest How it can be your friend or your enemy

Are Car Loans Simple Interest or Compound

Fixed Deposits Power Of Compounding, Interest Rate Frequency And Yield

Simple vs. Compound Interest How to Tell the Difference

The Power of Compound Interest Shift Realty Puerto Rico

Per annum interest calculator IsobelMurren

Difference Between Simple Interest and Compound Interest Examples

Simple and Compound Interest

Simple Interest Vs. Compound Interest What is the Difference? YouTube

Simple vs. Compound Interest Visual.ly Compound interest, Finance infographic, Financial

Compound Interest

Finance Affairs Blog Finance Affairs

Financial Terms from AZ CNBconnect

:max_bytes(150000):strip_icc()/dotdash-how-can-i-tell-if-loan-uses-simple-or-compound-interest-Final-17d192dbebc1467cad0e73f776fa7ffd.jpg)

Simple Interest vs. Compound Interest

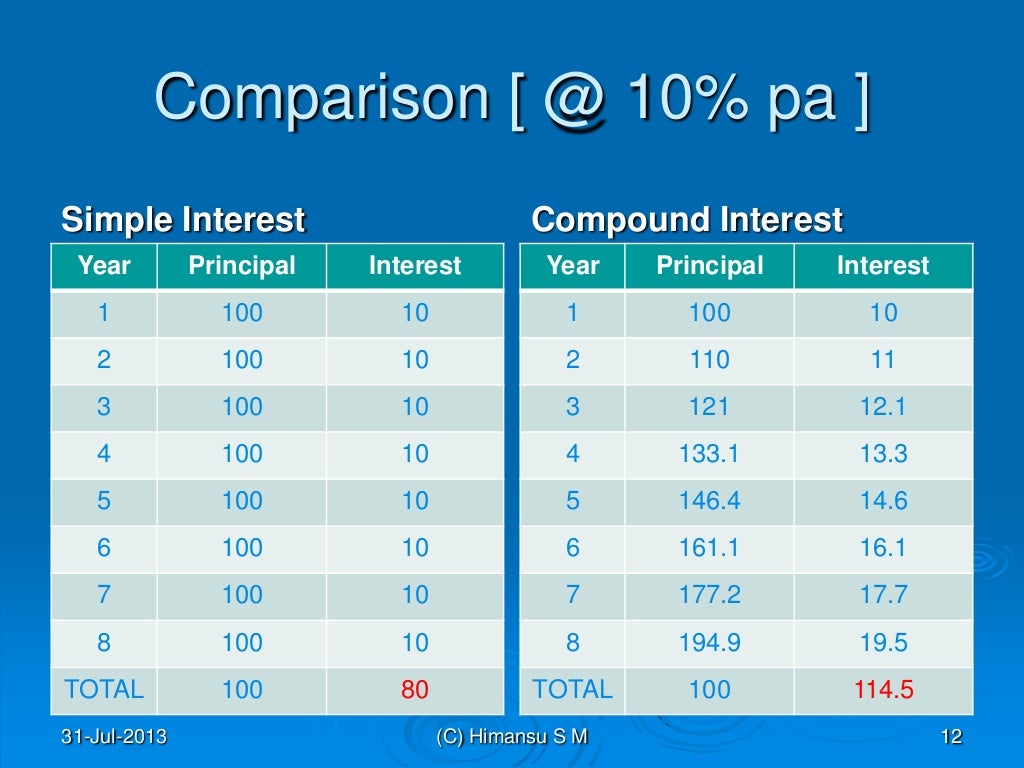

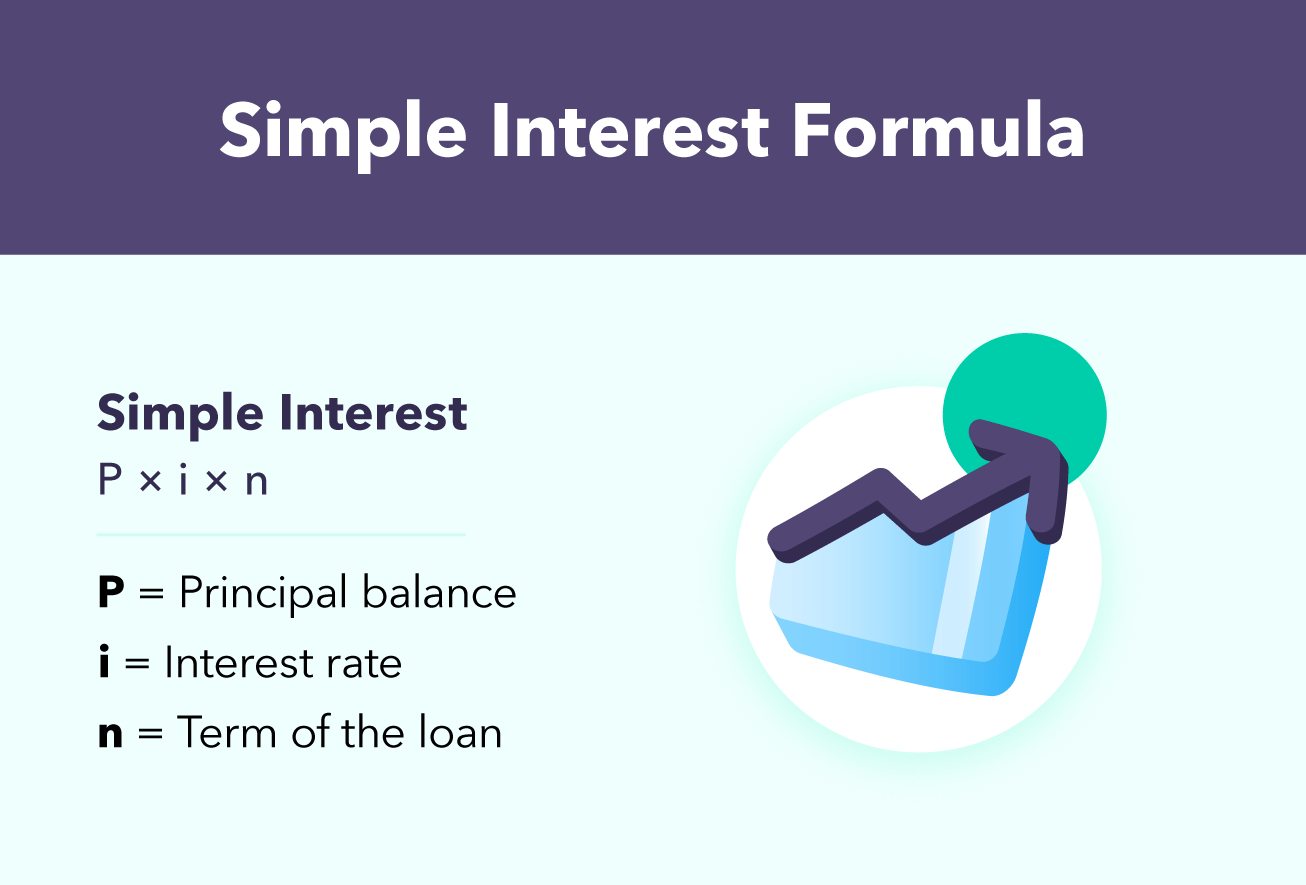

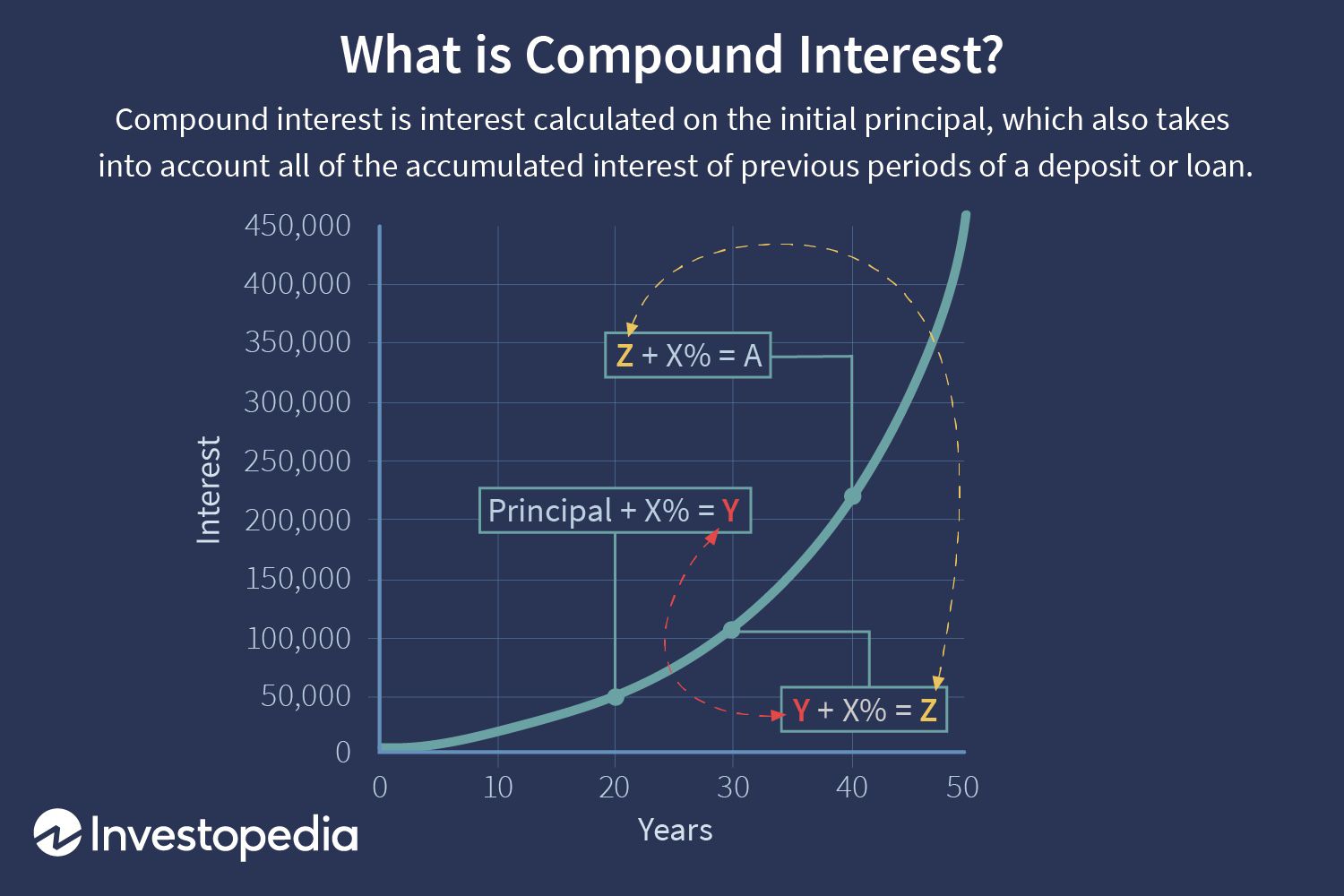

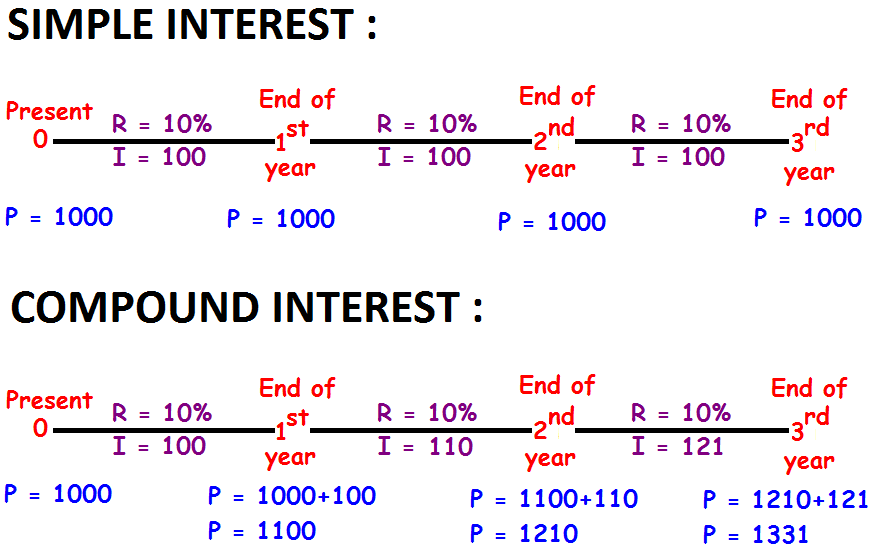

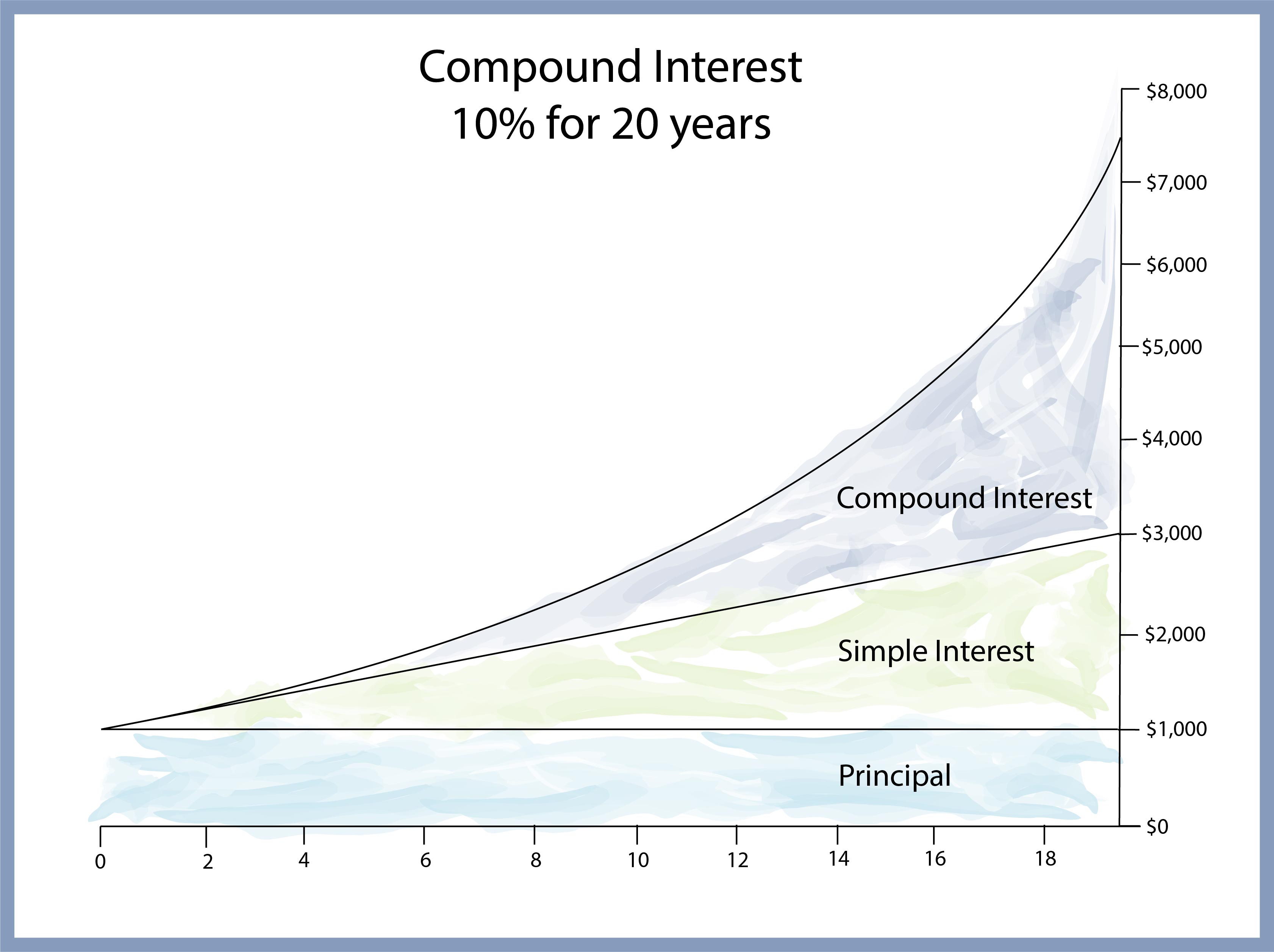

Here are some examples that illustrate when simple or compound interest is accrued and how the interest accrues differently: Certificate of deposit : A $1,000 five-year CD pays simple interest of 4%.. Here's the formula: Simple Interest = P x I x N. P = The loan amount. I = The interest rate. N = The duration of the loan using the number of periods. Compound interest refers to charges that the borrower must pay not just on the principal amount borrowed, but also on any interest accumulated at that point in time.