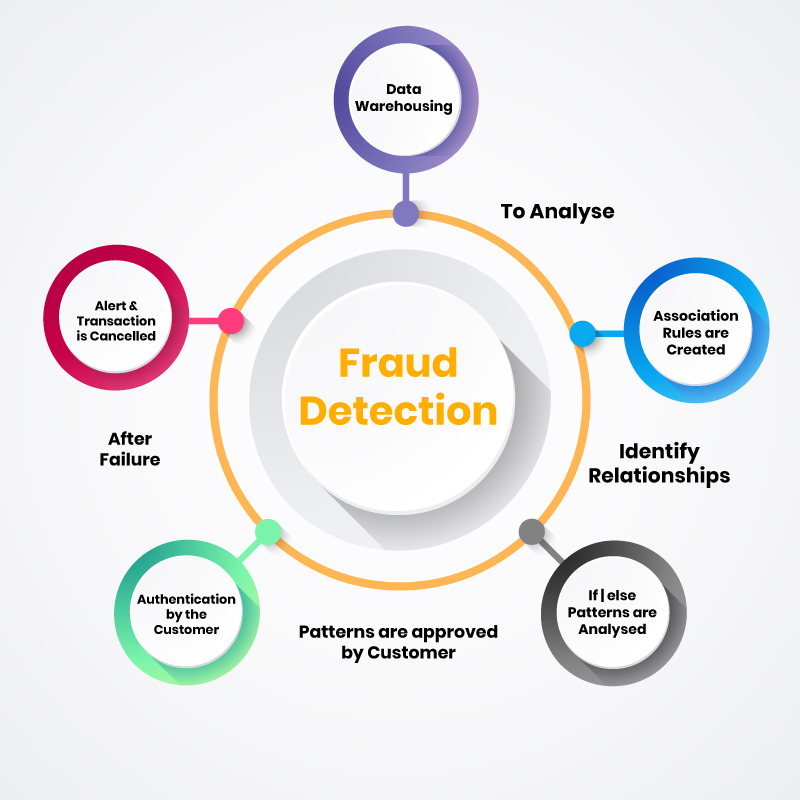

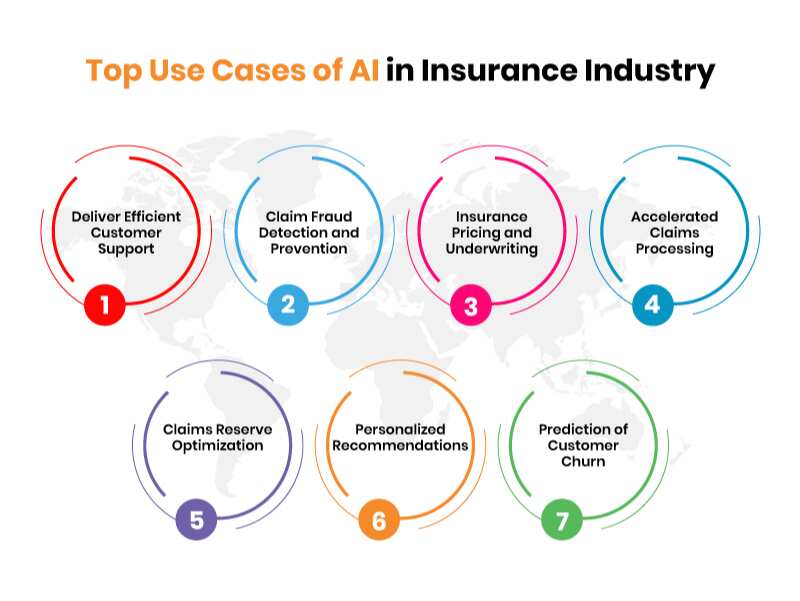

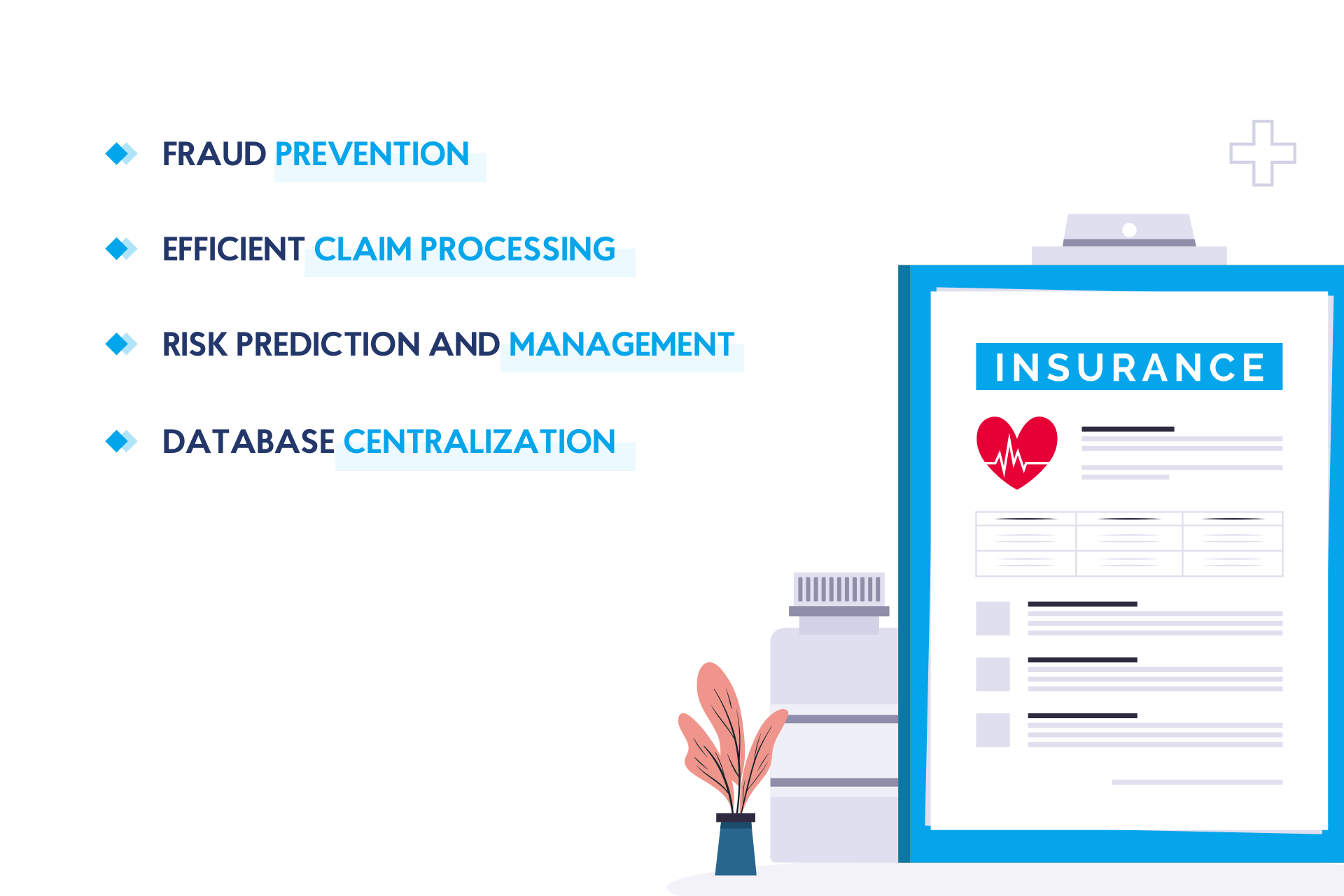

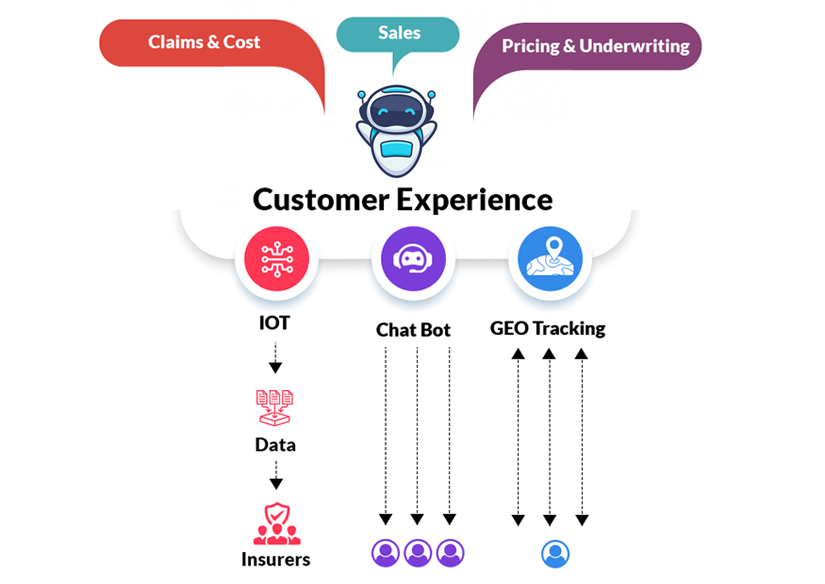

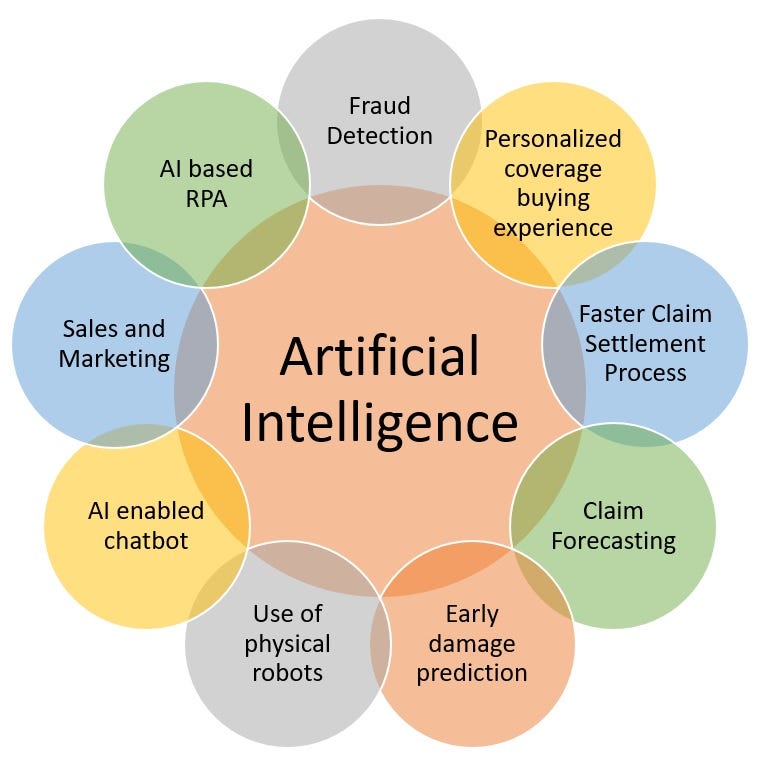

But another area where the insurance industry uses business intelligence is improving the customer experience. Business intelligence systems can: Reduce cycle time of claims. Reduce customer effort. Increase communications and touchpoints. Identify and eliminate roadblocks causing delays.. The insurance industry is poised to harness the latest technologies, including artificial intelligence (AI), to innovate and shape the future.. Artificial intelligence (AI) isn't new in insurance — existing use cases are seen across risk modeling, data forecasting, claims handling and contact center operations, with an abundance of.

Artificial Intelligence (AI) in Insurance Industry Benefits & Use Cases

(1).jpg)

How insuranceasaservice can transform your business model Blog post

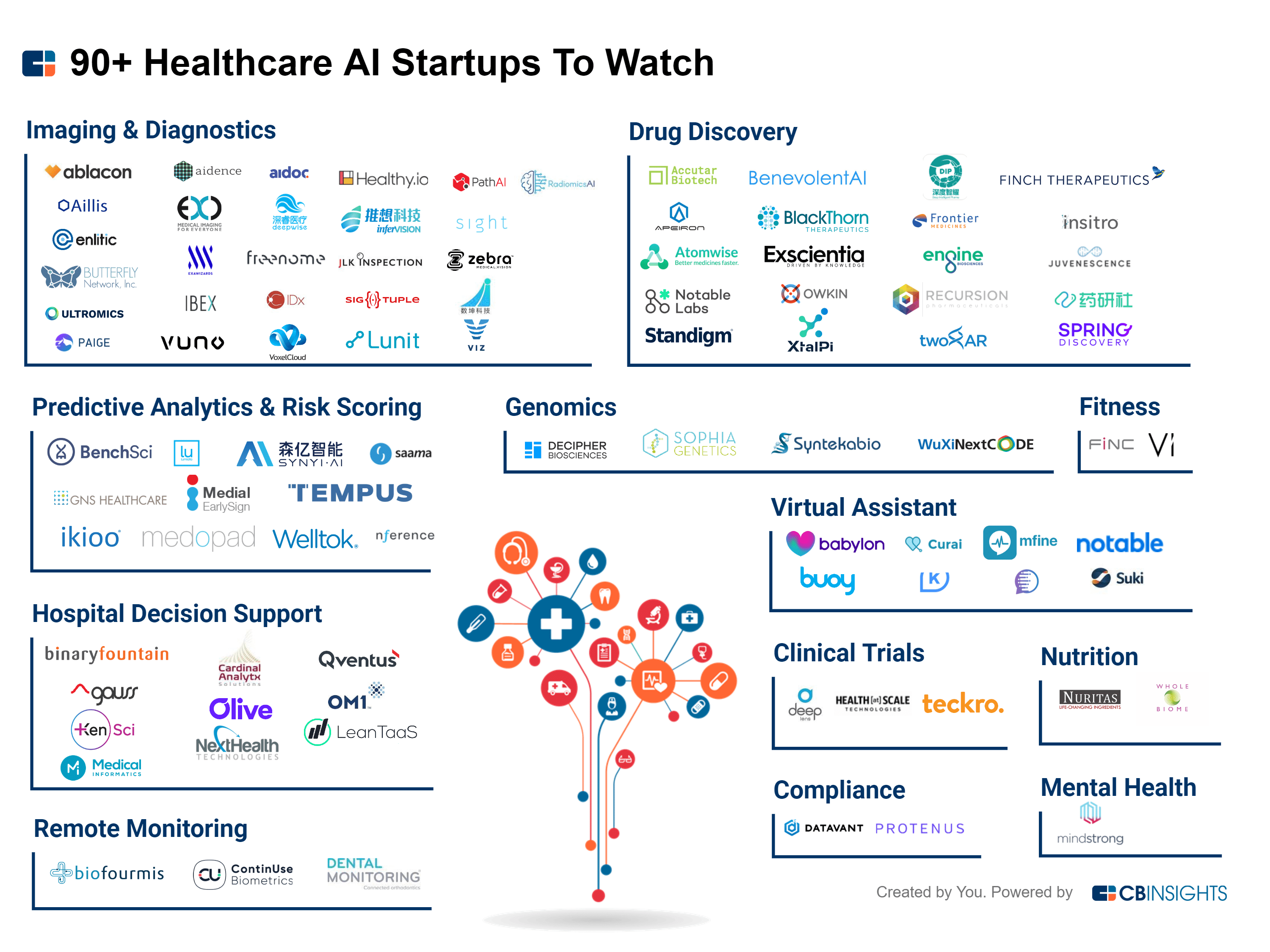

AI in Healthcare 90 Startups Making Noise in the Industry CB Insights

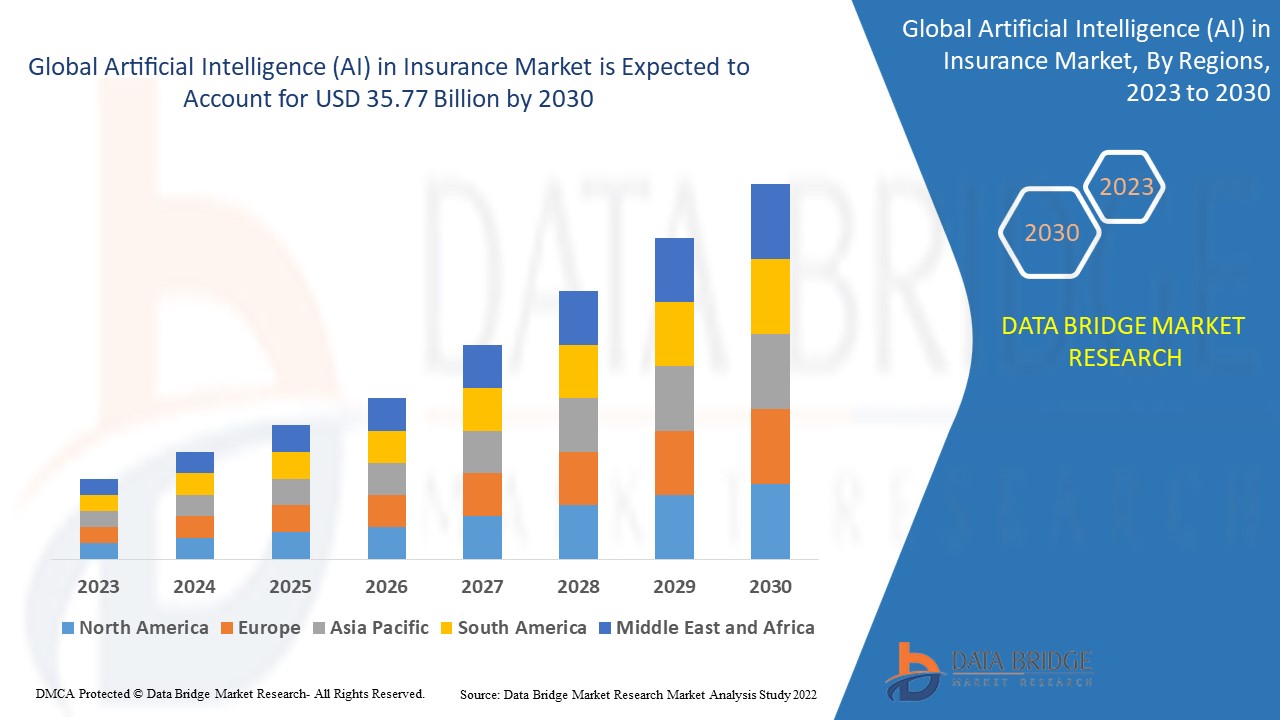

Artificial Intelligence (AI) in Insurance Market Size & Worth By 2030

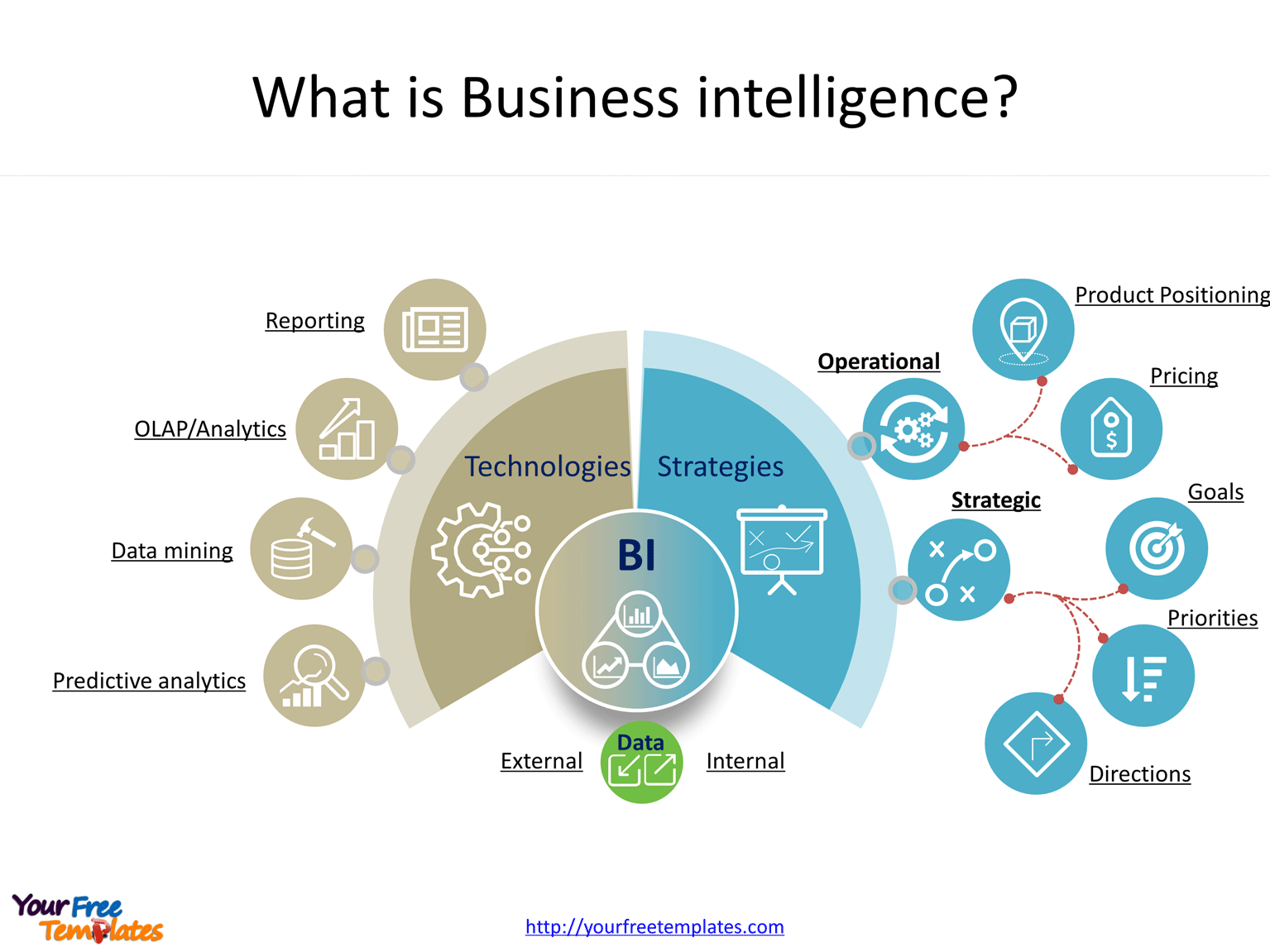

The Business Intelligence Cycle

SelfService Business Intelligence

Artificial Intelligence (AI) in Insurance Industry Benefits & Use Cases

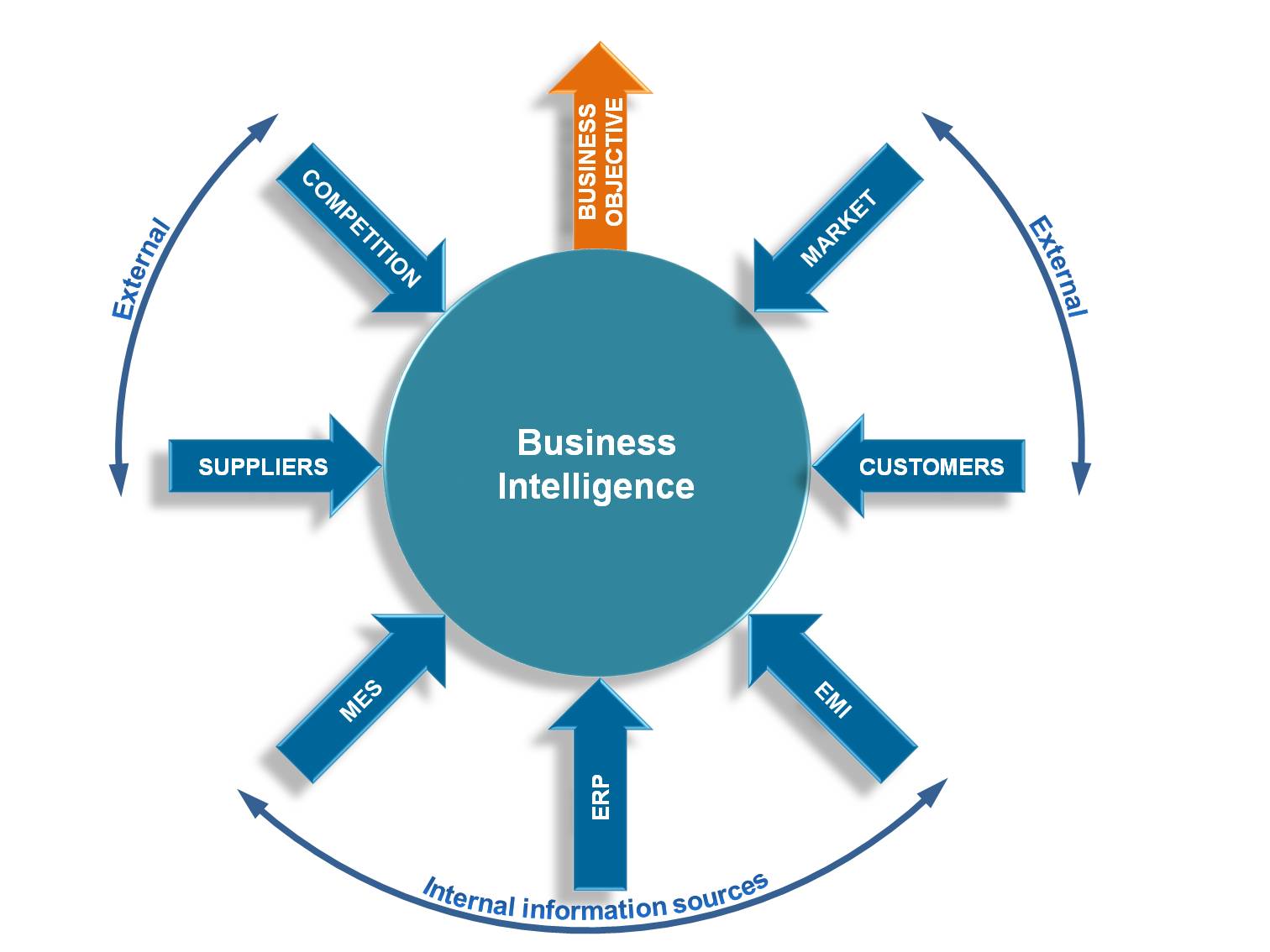

How can Business Intelligence transform the insurance industry?

7 Ways Insurance Companies Can Benefit From Business Intelligence

Artificial Intelligence A Boon for Insurance Underwriting

How Does the Technology Industry Use Business Intelligence NIX United

business intelligence overview ppt companies that use business

How AI and ML are Transforming the Insurance Industry, AI and ML in

Insurance Business Intelligence and Analytics in Claims YouTube

Two Factors Driving AI Adoption in the Insurance Industry Fintech Today

How would the insurance industry use business intelligence? Health Blog

Application of Artificial Intelligence Insurance Industry Seacrest

Business Intelligence Services & Solutions Provider Company in New

AI in the Insurance Industry Data Driven Investor Medium

How would the insurance industry use business intelligence? Health Blog

Business intelligence (BI) has emerged as a powerful tool for insurers to gain valuable insights into their operations, customers, and risks. By leveraging data analytics and visualization, insurers can make data-driven decisions, optimize pricing and underwriting. In this post, we'll explore the use-cases, benefits, and challenges of.. An April 2021 report published by GlobalData forecast that AI platform revenues within insurance would grow by 23% to $3.4 billion between 2019 and 2024. It was in this context that I recently.