Disadvantages of Being VAT Registered: Being VAT registered means you need to make VAT payments to HMRC and comply with VAT rules, which can be complex and time-consuming. Impact on Profit Margins : VAT adds an additional cost to your business, impacting your profit margins, especially if you can't fully reclaim VAT on your purchases.. 4. Competitive Parity: If your competitors are all VAT registered, not being written could make you seem less legitimate or more minor in comparison, even if you offer a better service or product. 5. B2B Attractiveness: Businesses prefer dealing with other VAT-registered businesses as it simplifies their accounting.

How can I stop being VATregistered? 03 December 2014 Premium

Should My Business Be VAT Registered (UK2021) Cooper Financials

Pros And Cons Of Being Vat Registered

Pros & Cons of Being VAT Registered (Advantages, Disadvantages)

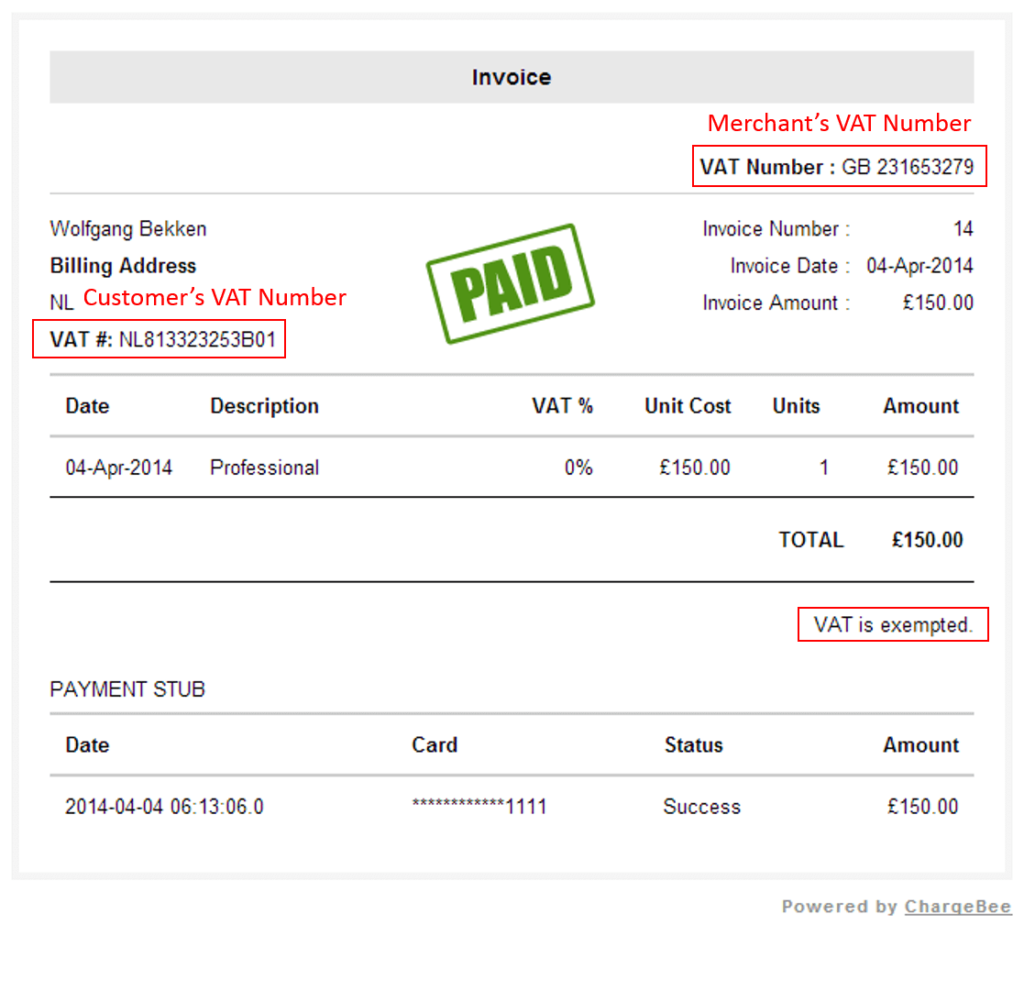

How to find a business's VAT number? Experlu

Clarifications on the VAT rules for Registered Business Enterprises (RBEs) under the CREATE Law

How To Pay VAT Online? Proven 6 Easy Methods Included

VAT or nonVAT What should you choose? JCSN Accounting Services

Benefits of being VAT registered Starling Bank

Killing Is My Business... And Business Is Good! The Final Kill》 Megadeth的专辑 Apple Music

New penalty 2022 Header

Being Vat Registered Is Killing My Business A Detailed Guide

Pros & Cons of Being VAT Registered (Advantages, Disadvantages)

Being VAT registered is killing my business

VAT Registration Certificate Koon Trading

What are the Benefits of Being VAT Registered? CruseBurke

The 5 Hidden Benefits of Being VAT Registered Article Madisons, Manchester

How VAT works and is collected (valueadded tax) Novashare

Being VAT Registered is Killing My Business (here's help)

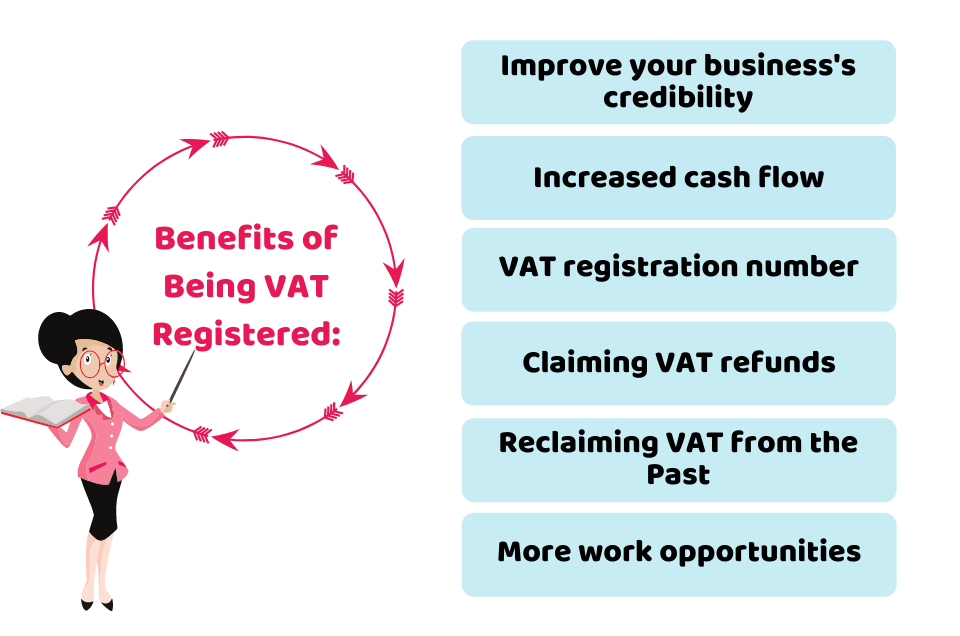

How to VAT Registered Premier Software

Home » » The Journal » How to Avoid Being Registered for VAT. The current threshold for compulsory VAT registration is taxable turnover of £85,000 in the last 12 months. This is a rolling measurement - if you look at the year to 30 June and you are under, that's fine. However, you then need to review for the year to 31 July, and so on.. Pros of being VAT Registered. When you're contemplating becoming voluntarily registered for VAT, some of these reasons may sway your decision towards it: You can apply VAT to the sale of almost any product or service. You can reclaim VAT on most products you purchase from other companies. It can be good for your marketing - seeing that a price.